Maldives, Republic of (Last reviewed 10 September 2023) Liechtenstein (Last reviewed 10 July 2023)ģ2 (see Lithuania's individual tax summary for rates for individual activity income and other non-employment-related income). Kyrgyzstan (Last reviewed 02 August 2023)Ģ5 for employment tax (by way of withholding by the employer) Korea, Republic of (Last reviewed 27 June 2023) Jersey, Channel Islands (Last reviewed 14 July 2023) See Ivory Coast's individual tax summary for salary tax, national contribution, and general income tax rates. Ivory Coast (Côte d'Ivoire) (Last reviewed 20 June 2023) 30% + 37% surcharge + 4% health and education cess) 30% + 25% surcharge + 4% health and education cess) Hong Kong SAR (Last reviewed 28 June 2023) Guernsey, Channel Islands (Last reviewed 30 June 2023) Lower of the Allowances Based system (16% - 41%) and Gross Income Based system (7% - 30%).

Gibraltar (Last reviewed 05 September 2023)

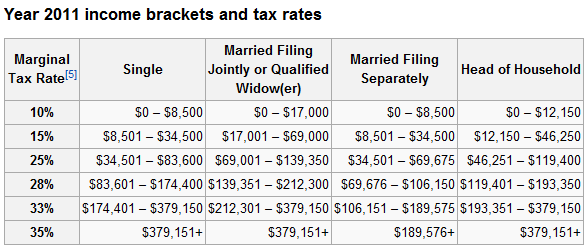

US FEDERAL TAX BRACKETS 2015 PLUS

Residents: Progressive tax rates up to approximately 55%ģ5, plus 5% complementary tax on salaries 52% + 8% labour market tax)ĭominican Republic (Last reviewed 12 January 2023)Įcuador (Last reviewed 01 September 2023)Įquatorial Guinea (Last reviewed 02 August 2023)Įthiopia (Last reviewed 07 December 2022) Provincial/territorial top rates range from 11.5% to 21.8%.Ĭayman Islands (Last reviewed 12 July 2023)Ĭhina, People's Republic of (Last reviewed 28 June 2023)Ĭongo, Democratic Republic of the (Last reviewed 31 December 2022)Ĭongo, Republic of (Last reviewed 16 July 2023)ģ0% increased for municipal tax (levied at the rates ranging from 0% to 18%, depending on taxpayer's place of residence).Ĭzech Republic (Last reviewed 27 July 2023) This report outlines a number of projections, including penalty amounts for failure to file, retirement planning figures, and income threshold, deduction and exemption amounts.25 (see Angola's individual tax summary for rates for self-employed workers and individuals carrying out an industrial or commercial activity)Īrgentina (Last reviewed 22 February 2023)ĥ5 (until 2025, after that it will be 50%)Īzerbaijan (Last reviewed 04 September 2023)īahrain (Last reviewed 13 September 2023)ĥ0 (plus communal taxes ranging between 0% and 9% of the Federal tax rate)īosnia and Herzegovina (Last reviewed 21 April 2023)Ĭambodia (Last reviewed 04 September 2023)Ĭameroon, Republic of (Last reviewed 01 August 2023) "Once again, our annual report provides actionable projections for tax professionals and taxpayers to begin planning for the upcoming year ahead of the official IRS announcement." inflation has contributed to a significant increase in inflation-adjusted amounts in the tax code," said Heather Rothman, vice president of analysis and content at Bloomberg Tax & Accounting, in a statement. For the SECURE 2.0 Act, changes include an increase in the wage limitation amount for the additional Section 45E credit for small employer pension plan startup costs from $100,000 to $140,000. For the Inflation Reduction Act, changes include an increase in the Section 4611(c) hazardous substance superfund financing rate and a bump up in the Section 179D deduction for energy-efficient commercial building property as long as new wage and apprenticeship requirements are met. The Blomberg report takes into account the tax changes made under last year's Inflation Reduction Act and the SECURE 2.0 Act.

0 kommentar(er)

0 kommentar(er)